Rolex CPO Market Update

By Danny Crivello & Jake Ehrlich

Time, as they say, really does fly...

It’s hard to believe, but it's already been 10 months since Rolex rolled out its highly anticipated Certified Pre-Owned (CPO) program in Europe through Bucherer.

I was talking with Jake about this story, and he said he thought Rolex should change "CPO" to "CPL," from Certified Pre-Owned to Certified Pre-Loved.

While Rolex's CPO program has gained momentum, especially in the U.S., sales still represent a small portion of the general pre-owned inventory sold online, according to an interesting report just released by WatchCharts and Morgan Stanley.

As of Oct. 1st, 2023, U.S.-based Tourneau totaled 1,400 Rolex watches listed online while Bucherer totaled just over 200, the report said. This figure will likely go up as new Rolex retailers in Europe join the CPO fray: Watches of Switzerland group, for example, will soon be selling certified pre-owned Rolex watches in the U.K.

The fact Rolex’s current CPO inventory primarily consists of references produced between 1990 and 2010 begs the question: Is there a growing demand for 13- to 30-year-old models, most of them equipped with smaller cases?

One school of thought suggests trends in sizes have changed. Another theory suggests modern pieces are still more popular, and Rolex owners would rather keep their watches than accept an authorized dealer’s offer. Meanwhile, newer models that are part of the CPO program tend to be snapped up at a higher rate, creating a disproportionate amount of neo-vintage Rolexes left in inventory.

IN ROLEX WE TRUST

Jake mentioned in the past Rolex was like a country, with Rolex watches being a highly trusted and sought-after currency, and store-of-value for wealth preservation. That's based largely on the fact Rolex watches are designed and built-to-last, and thus stand the truest test—of time. Jake is a designer, and to quote him again: "Timeless design, by definition, is when something appears to be from the past and future simultaneously." That sums up Rolex's overall value proposition.

Caveat Emptor

Interestingly, we continue to see a premium well over 20% when a piece is being listed through the Rolex CPO program. Rolex is extremely self-aware and savvy when it comes to understanding their market presence, as they have continually innovated their legendary playbook. This means clients are willing to pay a premium of at least 20% for a Certified Pre-Owned watch for the added 'peace-of-mind' and blessing of authenticity, coupled with quality assurance from Rolex which includes the invaluable Two-Year International Rolex guarantee.

So, if a customer isn't trying to flip a Rolex, but is investing in a long-term wrist companion that was previously loved, they are often willing to pay a premium for the blessing of authenticity from Rolex. Still, if they ever fall out of love, they could benefit from the CPO-added value to resell the watch.

It is worth noting Rolex customers who are loyal to the brand are likely willing to pay a premium for a pre-loved Rolex, especially if they can avoid having to wait on a vague waiting list.

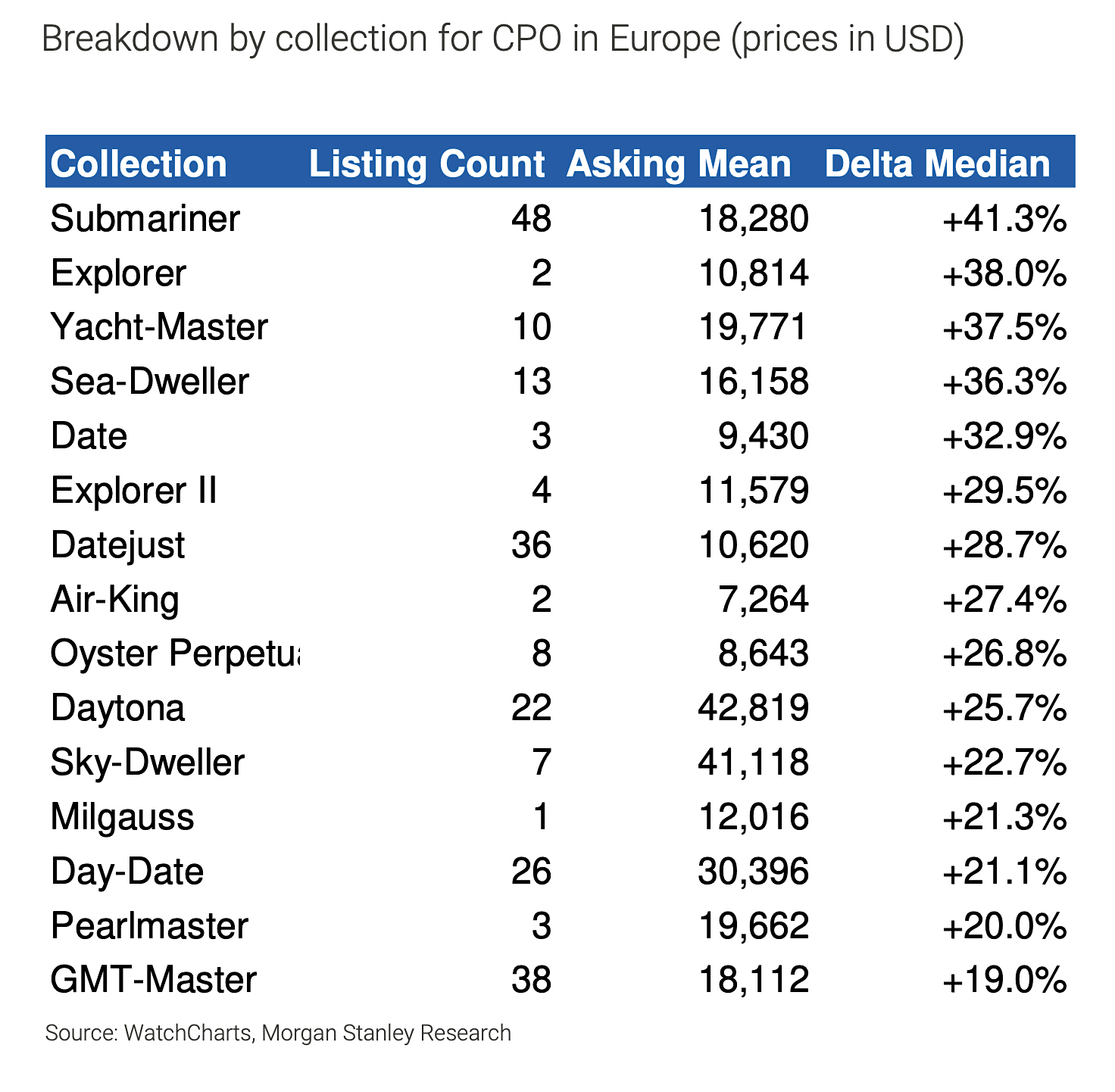

That premium seems to have increased now, at least in Europe, topping 30%. All that according to the report, which compares the price of each Rolex CPO listing to typical prices for the same watch sold by a non-Rolex certified dealer in the same geographical region.

In short, when compared to the previous quarter, Rolex CPO premiums have increased several points, from 20%-25% to 28%-30%, above non-CPO pricing, the latest sign Rolex authorized dealers involved in the program have felt little pressure from the traditional grey market.

The CPO program can be considered a success if authorized dealers can continue to carry that double-digit premium over pre-owned pieces on the grey market. Rolex clients seem to appreciate this added value proposition.

It's interesting to note the difference in apparent popularity of different Rolex models between the USA and European markets as seen above and below.

Rolex really seems to sum it up perfectly when they said: "Because they are built to last, Rolex watches often live several lives."

A note from Jake:

Grey Market Circumvention

Captain Danny's article is brilliant as it really captures the essence of Rolex's CPO program. In my mind, this program achieves two innovative goals. It is an opening salvo against the grey market, at least for customers who want to own and wear a Rolex as apposed to flipping it.

Secondly, I remember a fascinatingly insightful strategic marketing story someone once shared with me about De Beers slogan that said "A Diamond is Forever." They said the challenge De Beers had back in the late 1940s, was women were fickle when it came to jewelry, and would often get sick of and want to sell their old jewelry, or diamonds. This meant that De Beers primary market had to compete with the broader secondary market which cannibalized the former.

In other words, if somebody obtained a diamond and later sold it, they would put it up for sale in the secondary marketplace, which would compete with De Beers in the primary marketplace. The logic was if De Beers could convince ladies not to sell their used diamonds into the secondary marketplace, they would in effect have a monopoly of sorts on the primary marketplace. This De Beers campaign first rolled out in 1953 (same year Rolex developed the Submariner) in the major motion pictured titled "Gentlemen Prefer Blondes" with Marylin Monroe telling women Diamonds Are a Girls Best Friend, as they will never grow old or leave you:

Thus, De Beers came up with the subtle marketing messages of: "Diamonds Are A Girls Best Friend" and "Diamonds are Forever". They also came out with a James Bond film titled "Diamonds are Forever" in 1971 that featured Sean Connery as Secret Agent 007. A Diamonds is Forever sends a subliminal message that once a woman obtains a diamond she should never part with it, and thus wipes-out the secondary market.

Rolex was brilliant as they did the opposite by embracing the secondary market with forming their Rolex CPO program, which seeks to add additional value to used Rolex watches, not only in the primary, but in the secondary, and potentially tertiary marketplaces, which creates a win/win/win for Rolex as well as for loyal customers in the secondary and tertiary marketplaces.

ROLEX Piece of Mind

There is another benefit I can think of for the CPO program, and that has to do with the peace of mind that comes from purchasing a used Rolex that has been certified as being authentic by Rolex.

I remember back in 1996 buying my first stainless steel Rolex Daytona. It's hard to believe, now that I think about it, that I bought my first Daytona more than 25 years ago!?!! I bought a grey market stainless steel Daytona for around $10K, and the actual watch I bought is pictured below.

As I recall, it was the first Rolex I bought from a grey goods dealer in California, who I didn't know prior to purchasing from him. He seemed like a trustworthy dude, but after I bought the watch I started second-guessing myself, and wondered it if was 100% legit? So I came up with a brilliant idea. I took the Daytona to the Officially authorized Rolex service center in San Francisco, and I waited my turn. A Rolex watchmaker in a white lab coat greeted me and said "How can I help you?'

I responded and asked if he could take a look at the Daytona and confirm it was authentic? I handed him the watch, and then the strangest, most unexpected thing occurred. He didn't take the watch in the back, nor did he open the back of the watch as I thought he might. He didn't even pull out a loupe to take a closer look at the watch. Instead, he held it in his right hand, and brought it to within about 6 inches of his eyes, shook it and listened to the rotor fly around in the watch, then less than 10 seconds after I handed it to him, he handed it back to me and said: "It's real!" I said "Are you sure???" He said yes. I asked, "Isn't there something else you would want to do to authenticate it? He rolled his eyes in a tolerative way and said, "No."

I walked out and was kinda shocked and didn't really know what to make of the experience. My point is if I had purchased the watch through Rolex's CPO program, it would have given me complete peace of mind, which for many people is invaluable.